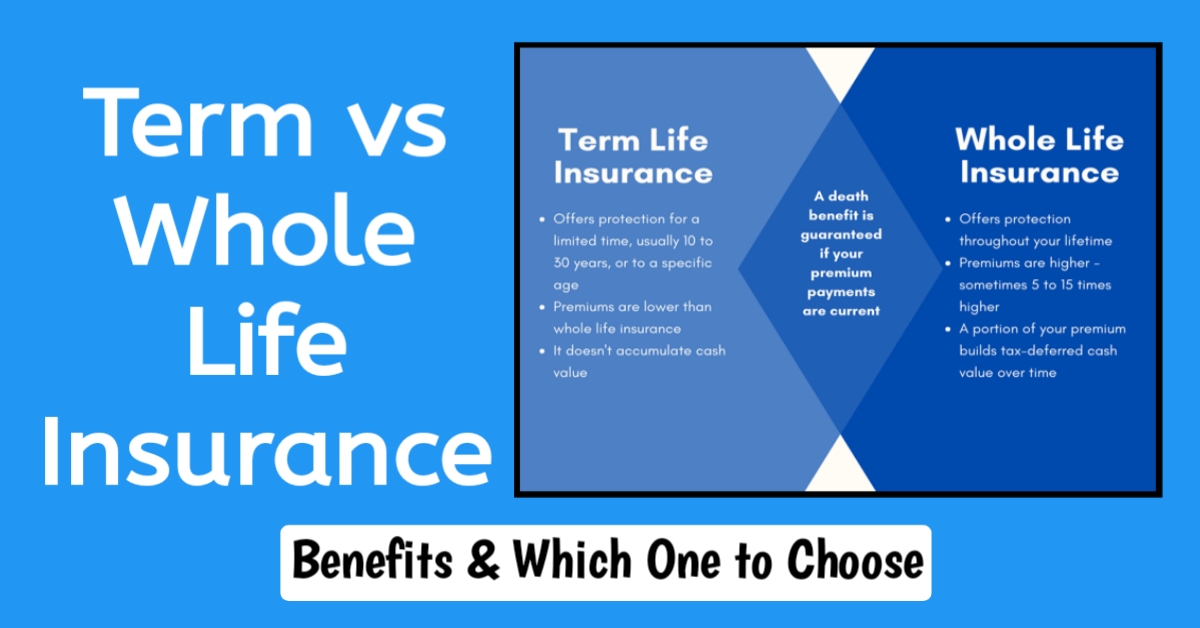

Compare Term Life Insurance and Whole Life Insurance is a important than financial decision. Both policies offer life coverage but differ in duration, benefits, and cost. Understanding their differences helps in selecting the right plan for your needs. Term vs Whole Life Insurance.

What is Term Life Insurance?

Term Life Insurance provides coverage for a fixed period, typically 10, 20, or 30 years. If the insured passes away during the term, the death benefit is paid to beneficiaries.

Benefits of Term Life Insurance:

- Lower premiums compared to whole life.

- Simple coverage without investment components.

- Flexible term lengths.

Best For:

Individuals seeking affordable protection for specific periods, such as during mortgage years or while raising children.

What is Whole Life Insurance?

Whole Life Insurance provides lifetime coverage with fixed premiums. It is includes a cash value component that insurance is grows over time.

Benefits of Whole Life Insurance:

- Lifetime protection.

- Guaranteed death benefit.

- Cash value accumulation for loans or withdrawals.

Best For:

Individuals seeking lifelong coverage and a financial tool for estate planning or wealth building.

Term vs Whole Life Insurance

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Duration | Fixed term (10–30 years) | Lifetime |

| Premiums | Lower | Higher (but fixed) |

| Cash Value | None | Yes, grows over time |

| Flexibility | Adjustable term options | Lifetime with cash benefits |

| Best Use | Temporary needs | Long-term wealth & estate planning |

Which Policy Should You Choose?

- Term Life Insurance if you want affordable coverage for specific financial obligations like loans, education, or income replacement.

- Whole Life Insurance if you want lifetime security, estate planning benefits, or investment growth through cash value.

The End

Term vs Whole Life Insurance, the best choice depends on your financial goals, budget, and long-term plans. Term is budget-friendly for temporary needs, while Whole Life offers lifelong protection and financial growth.